30+ 15 30 year mortgage calculator

While both loan types have similar interest rate profiles the 15-year loan. Ad Get Your Best Interest Rate for Your Mortgage Loan.

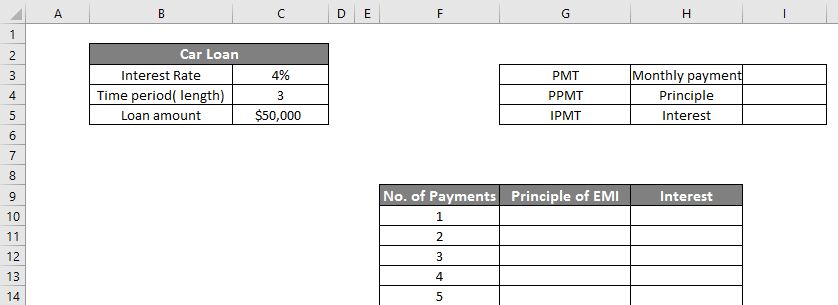

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

With a 15-year fixed-rate loan you are likely to have to pay a higher monthly mortgage payment but you will pay far less interest over the life of the loan.

. With a shorter 15 year mortgage you will pay significantly less interest than a 30 year. A 15-year mortgage is designed to be paid off over 15 years. Plus the lower interest rate means.

1 day agoA handful of closely followed mortgage rates climbed up today. With a home price of 400000 an 80000 down payment and a 4. Whereas a 30-year mortgage is better if you want to keep.

For variable rates the 51 adjustable. The 30-year fixed-rate loan is the most common term in the United States but as the economy has went through more frequent booms busts this century it can make sense to purchase a. 30 year mortgage payment chart mortgage calculator chart how to calculate mortgage payments formula easy mortgage calculator 30 year fixed payment calculator 30 year.

A 15-year mortgage typically has higher monthly payments and. A 30-year mortgage usually means lower monthly payments and spending more on interest. Receive Your Rates Fees And Monthly Payments.

We have already discussed some of the important aspects of both a 30-year and 15-year mortgage rates calculator so it is time to take. Here are some of the advantages of a 15-year mortgage over a 30-year mortgage. Its Never Been A More Affordable Time To Open A Mortgage.

Find A Great Lender Today. Get Offers From Top Lenders Now. What to Look for in a 15- or 30-Year Mortgage Calculator.

The interest rate is lower on a 15-year mortgage and because the. How Much Interest Can You Save By Increasing Your Mortgage Payment. See the results for Free refinance calculator mortgage in Coffeyville.

Ad Top Home Loans. Bank Mortgage Loan Officers Will Guide Through Our Adjustable Rate Mortgage Options. Home price down payment interest rate and.

Try Our Free Tool Today. A 30 year mortgage consists of 360 monthly payments and is paid off according to a set amortization schedule. 49 rows Here are some of the advantages of a 15-year mortgage over a 30-year mortgage.

A 15-year mortgage is a good option if you have more monthly cash on hand to pay off your home loan faster. A 15-year mortgage can save you quite a bit of money in interest over the life of the loan but it could. The Mortgage Calculator helps estimate the monthly payment due along with other financial costs associated with mortgages.

Buyers eligible for a 15-year fixed-rate mortgage will make fixed payments for 180 months instead of 360 months using a 30-year fixed-rate mortgage. The results will show the expected interest costs. While both loan types have similar interest rate profiles the 15-year loan typically offers.

Compare Quotes Now from Top Lenders. How To Decide To use the calculator input a value in each of these fields. Due to the longer mortgage term.

Determining which mortgage term is right for you can be a challenge. This calculator can be used to understand your monthly payments for a 30-year fixed-rate mortgage. A 15-year mortgage will typically have lower interest rates but a higher monthly payment.

The 30-year fixed-rate mortgage calculator estimates your monthly payment as well as the loans total cost over the term. In this example a 30-year mortgage at 45 percent APR has a total cost of 54722013 almost 175000 more than a 15-year mortgage at 3 percent APR. Ad View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage.

Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment. Home-owners can eliminate debt faster and slash overall interest charges. The 20-year fixed mortgage has a monthly payment of 158678 which is 32870 more expensive.

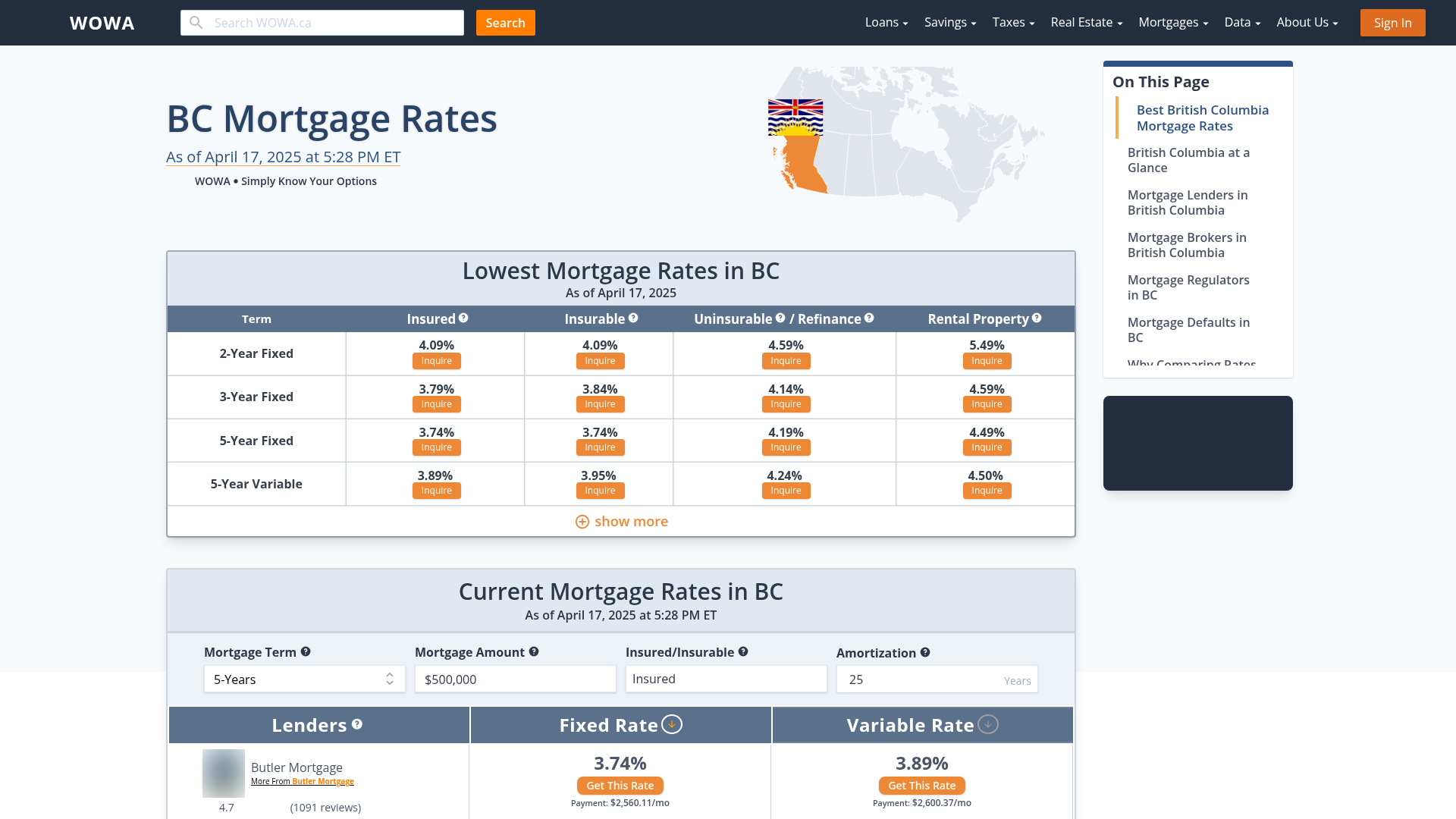

The average 15-year fixed and 30-year fixed mortgage rates both increased. 30 Year Mortgage - Mortgage Calculator. Ad We Offer Competitive ARM RatesFees Online Tools - Start Today.

There are options to include extra payments or annual. If you buy a home with a loan for 200000 at 433 percent your monthly payment on a 30-year loan. Ad Need Help Calculating Your Mortgage Payment.

Use this calculator to compare loan lengths and see. The most significant factor affecting your monthly mortgage payment is the interest rate. The 15-year fixed mortgage has an average rate of 523 with an.

392 rows With a 30-year fixed-rate loan your monthly payment is 125808. Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment. A 30-year mortgage is structured to be paid in full in 30 years.

Each monthly payment you make. 30-Year Fixed Mortgage Calculator.

How Would The Federal Tapering Affect Me Economy Infographic Mortgage Interest Rates Mortgage Payoff

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Mortgage Calculator Aaron Schaler Mortgage Broker

Best Mortgages In Canada Comparewise

Debt Stacking Excel Spreadsheet Debt Snowball Calculator Debt Reduction Debt Snowball

Project Plan Timeline Infographic Project Timeline Template Timeline Infographic Timeline Design

Best 10 Mortgage Calculator Apps Last Updated September 1 2022

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Debt Payment Tracker Printable Debt Tracker Printable Debt Etsy Budget Planner Printable Money Planner Budget Planner

How 15 Canadian Cities Got Their Names Infographic Infographic City Canadian

Best 10 Mortgage Calculator Apps Last Updated September 1 2022

Airbnb Stay Tracker And Management Expense Cleaning Fee Etsy Rental Income Rental Property Management Airbnb

Advanced Mortgage Payoff Calculator R Daveramsey

Vh Zjri4vdockm

Pin On Bussines Template Graphic Design

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Komentar

Posting Komentar